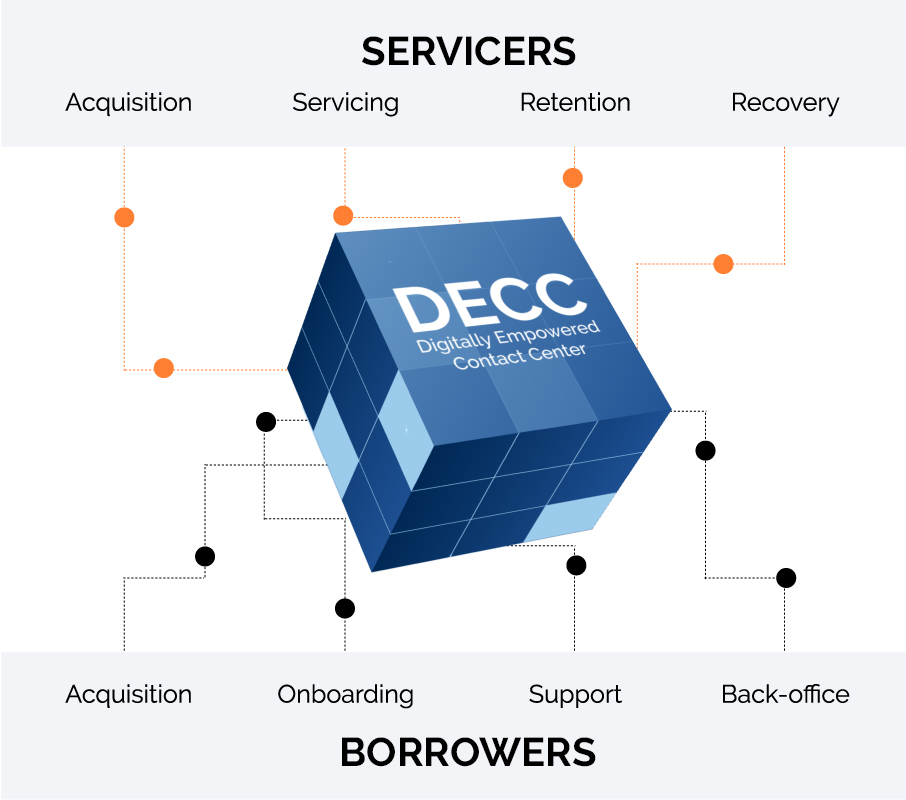

Modern home buyers expect seamless digital services but they also want the human touch. Our Digitally Empowered Contact Center solution (DECC) combines the best of what humans and technology have to offer to deliver the moments that matter - across the mortgage lifecycle.

Despite consumer expectations for digital services, the mortgage loan process is still highly paper based. Lenders and servicers must track documents across the lifecycle, identify and gather missing data, and ensure that all stakeholders receive the right information at the right time. Our Digitally Empowered Contact Center solution enables mortgage companies and consumers to benefit from a high-tech process that accelerates efficiencies as well as the human-touch, building transparency and trust. How do we do this? Our approach is based on four foundational pillars of customer experience: creating anywhere, anytime access to a flexible workforce; enabling channel freedom for borrowers; harmonizing humans and technology; and leveraging real time dashboards and insights.

Elevate the borrower experience

Elevate the borrower experience

Home buying is one of the biggest decisions people make in their lifetime. Unsurprisingly, today’s home buyers crave digital self-service across the mortgage loan process in combination with a human touch. Our contact center solutions help you deliver frictionless support geared to individual financial needs, meeting customers where they are. It digitizes processes and paperwork for enhanced agility and efficiency, and supplements it with empathetic human interaction across the mortgage lifecycle.

See DECC in action

Smart mortgage experiences powered by AI

Intelligent Everything People & Technology

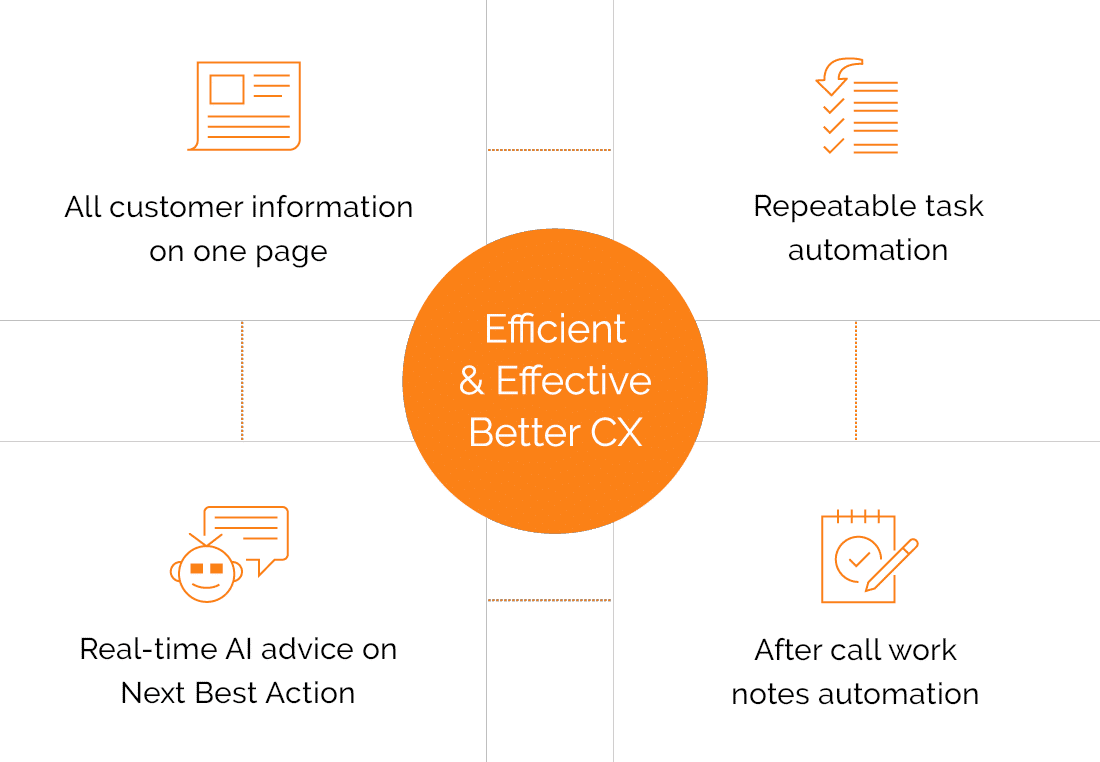

When bots pick up mundane, repetitive tasks such as fetching borrower information from multiple systems, human conversations become more efficient and meaningful. A whopping third of all borrower requests can be handled by chatbots, enabling you to offer 24/7 customer support and freeing up your associates to handle complex conversations.

DECC leverages CoBots, unattended digital employees that use Robotic Process Automation (RPA), to increase process efficiency across widely used mortgage applications. It also creates a Unified Omnichannel Desktop and displays Next Best Actions to inform associates, helping them tailor the mortgage experience and build long-term relationships.

From outsourcing to innovation: partnering to revolutionize mortgage servicing

HFS Point of View

Explore insights

-

Case study

Sourcepoint remotely deploys, integrates and scales customer intelligence solution for a top-5 US mortgage company

-

Case study

firstCustomer Intelligence (FCI) boosts borrower experience and improves sales conversion for top 10 lender

-

Blog

Omnichannel engagement: the key to better mortgage customer experiences